The smart Trick of Pvm Accounting That Nobody is Talking About

Table of ContentsThe smart Trick of Pvm Accounting That Nobody is Talking AboutPvm Accounting - An OverviewNot known Details About Pvm Accounting Not known Facts About Pvm AccountingAbout Pvm AccountingThe Ultimate Guide To Pvm Accounting

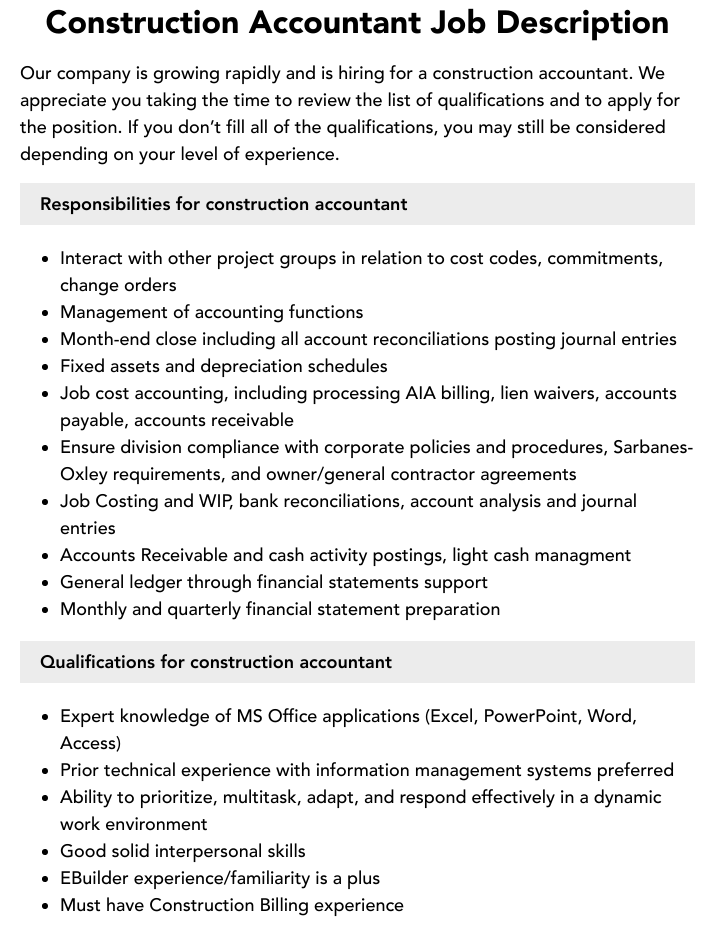

Look after and take care of the development and authorization of all project-related billings to clients to cultivate great communication and prevent concerns. construction taxes. Ensure that proper records and documentation are submitted to and are updated with the IRS. Make certain that the accounting process adheres to the law. Apply needed construction bookkeeping requirements and procedures to the recording and reporting of building task.Understand and keep basic expense codes in the audit system. Communicate with various funding firms (i.e. Title Firm, Escrow Firm) regarding the pay application procedure and needs required for settlement. Take care of lien waiver dispensation and collection - https://qualtricsxm393lvkdr7.qualtrics.com/jfe/form/SV_1ZFKTDPbSLOjslU. Display and deal with bank issues including cost abnormalities and inspect differences. Help with implementing and preserving interior financial controls and procedures.

The above statements are planned to define the general nature and level of work being carried out by people appointed to this category. They are not to be taken as an extensive listing of obligations, tasks, and skills required. Employees might be called for to perform duties beyond their typical responsibilities every now and then, as needed.

The Ultimate Guide To Pvm Accounting

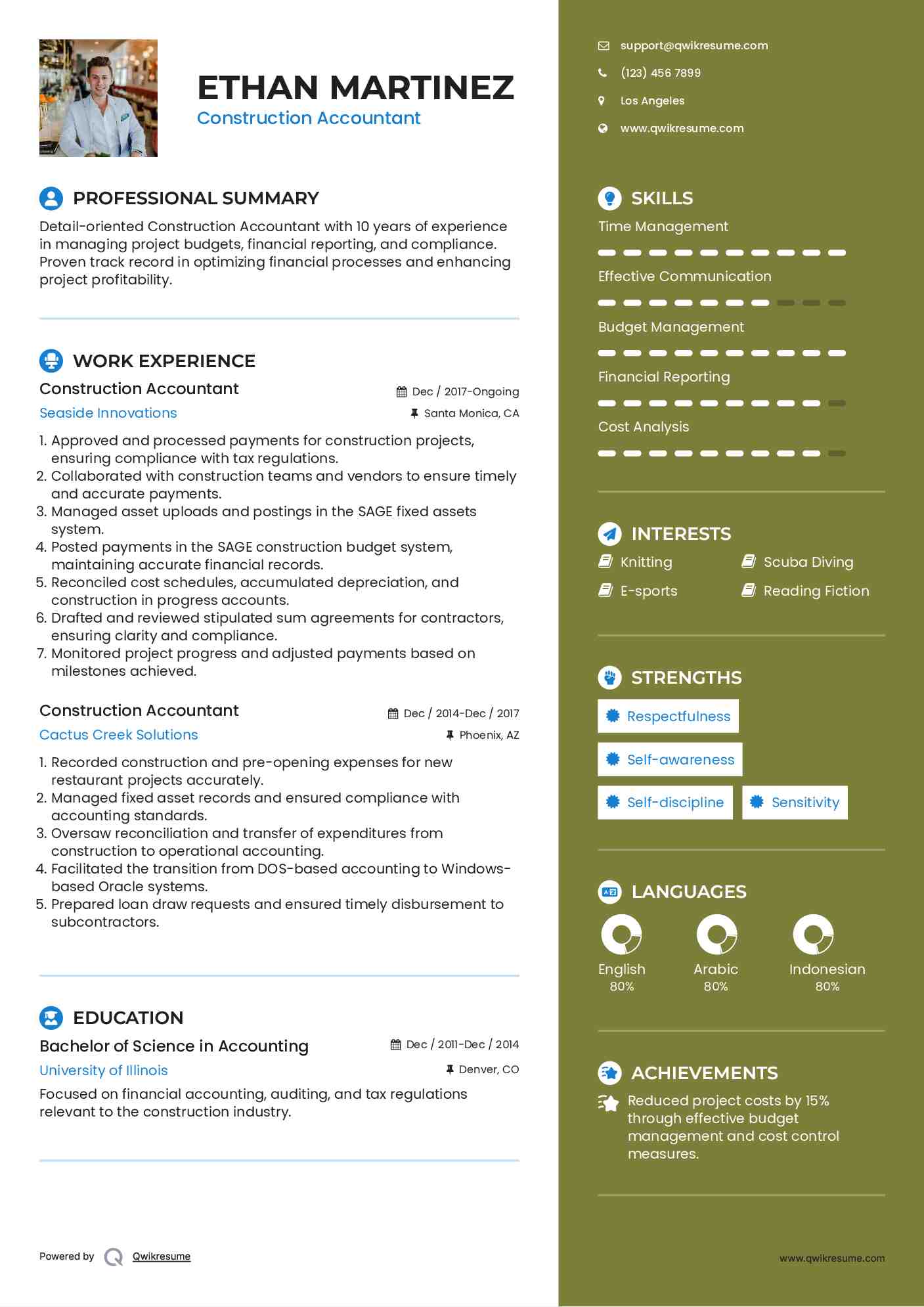

You will certainly help sustain the Accel group to make sure distribution of successful promptly, on budget plan, tasks. Accel is seeking a Building Accounting professional for the Chicago Office. The Building Accounting professional carries out a range of audit, insurance policy compliance, and task administration. Functions both individually and within particular divisions to maintain economic documents and make certain that all documents are maintained current.

Principal tasks consist of, yet are not restricted to, dealing with all accounting functions of the business in a prompt and accurate manner and supplying records and routines to the company's CPA Company in the prep work of all monetary declarations. Makes certain that all accounting procedures and functions are managed accurately. Accountable for all economic documents, pay-roll, financial and daily procedure of the accountancy feature.

Prepares bi-weekly test equilibrium records. Works with Project Supervisors to prepare and post all month-to-month billings. Processes and issues all accounts payable and subcontractor repayments. Generates monthly wrap-ups for Workers Compensation and General Obligation insurance coverage premiums. Creates regular monthly Job Cost to Date records and collaborating with PMs to reconcile with Job Supervisors' allocate each task.

Pvm Accounting for Beginners

Efficiency in Sage 300 Building and Genuine Estate (previously Sage Timberline Office) and Procore building management software application a plus. https://pvm-accounting-46243110.hubspotpagebuilder.com/blog/building-financial-success-with-construction-accounting. Must additionally excel in other computer system software systems for the preparation of records, spreadsheets and various other accounting analysis that might be required by administration. financial reports. Should have solid business abilities and capability to focus on

They are the financial custodians who guarantee that building tasks continue to be on budget, adhere to tax regulations, and preserve economic openness. Building and construction accountants are not just number crunchers; they are calculated companions in the building and construction procedure. Their primary role is to handle the monetary facets of building and construction tasks, ensuring that resources are assigned effectively and monetary risks are reduced.

Pvm Accounting for Beginners

They function closely with project supervisors to produce and keep an eye on budget plans, track costs, and forecast economic requirements. By preserving a tight grip on task financial resources, accountants assist prevent overspending and financial troubles. Budgeting is a foundation of successful construction tasks, and building and construction accountants are important in this regard. They develop comprehensive budgets that incorporate all job expenses, from products and labor to permits and insurance coverage.

Building and construction accounting professionals are well-versed in these policies and make sure that the task abides with all tax needs. To excel in the role of a building accounting professional, people need a solid instructional foundation in accounting and finance.

Furthermore, certifications such as Cpa (CPA) or Certified Building Market Financial Expert (CCIFP) are extremely concerned in the market. Working as an accountant in the building market includes an one-of-a-kind collection of obstacles. Building and construction tasks usually entail limited target dates, altering guidelines, and unforeseen expenses. Accountants should adapt quickly to these obstacles to maintain the project's financial health undamaged.

See This Report about Pvm Accounting

Ans: Construction accountants produce and keep track of budget plans, determining cost-saving possibilities and making certain that the job remains within budget plan. Ans: Yes, construction accounting find out professionals take care of tax obligation compliance for building projects.

Introduction to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make challenging selections among numerous economic alternatives, like bidding process on one task over another, picking funding for products or devices, or establishing a project's revenue margin. Building is a notoriously volatile market with a high failing price, slow time to payment, and inconsistent cash circulation.

Manufacturing involves repeated procedures with easily recognizable prices. Production needs various processes, products, and equipment with varying expenses. Each task takes place in a new area with varying website problems and unique difficulties.

Pvm Accounting Can Be Fun For Anyone

Regular use of various specialty service providers and providers affects performance and cash money circulation. Repayment shows up in full or with normal settlements for the full contract quantity. Some portion of payment might be kept until project conclusion also when the service provider's job is completed.

While typical producers have the benefit of controlled atmospheres and enhanced production procedures, construction business must regularly adjust to each new job. Also somewhat repeatable tasks require adjustments due to website conditions and other factors.

Comments on “The smart Trick of Pvm Accounting That Nobody is Discussing”